Investment Bank

M&A, Private Equity & LP Equity for CRE

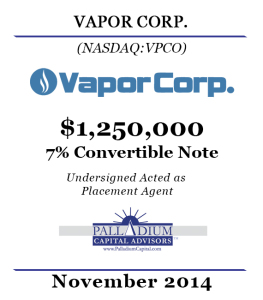

Palladium Capital Advisors Completes $1,250,000 Private Placement for Vapor Corp. (NasdaqCM:VPCO)

New York, NY–(November 17, 2014) – Palladium Capital Advisors, LLC today announced that it acted as placement agent for Vapor Corp. in its $1,250,000 private offering of 7% convertible notes.

New York, NY–(November 17, 2014) – Palladium Capital Advisors, LLC today announced that it acted as placement agent for Vapor Corp. in its $1,250,000 private offering of 7% convertible notes.

About Vapor Corp.

Vapor Corp., a NASDAQ listed company, is a U.S. based electronic cigarette and vaporizer company, whose brands include emagine vaporTM, Krave®, VaporX®, Hookah Stix®, Alternacig® and Fifty-One®. We also design and develop private label brands for some of our distribution customers. “Electronic cigarettes” or “e-cigarettes,” and “Vaporizers,” are battery-powered products that enable users to inhale nicotine vapor without smoke, tar, ash or carbon monoxide. Vapor’s electronic cigarettes, vaporizers and accessories are available at Company owned retail kiosks, online, through direct response to our television advertisements and through retail locations throughout the United States. For more information on Vapor Corp. and its e-cigarette and vaporizer brands, please visit us at www.vapor-corp.com.

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to those regarding the proposed merger and proposed financing. Such statements are not historical facts and include expressions about management’s confidence and strategies and management’s expectations about new and existing programs and products, relationships, opportunities, taxation, technology and market conditions. These statements may be identified by such forward-looking terminology as “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,” “usually,” “anticipate,” or similar statements or variations of such terms. Such forward-looking statements involve certain risks and uncertainties. Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ from those contemplated by such forward-looking statements include, but are not limited to, the following: failure to enter into a definitive merger agreement for the proposed merger; failure to enter into the second and third financing transactions in connection with the proposed merger, reaction to the proposed merger of Vapor’s customers and employees; the diversion of management’s time on issues relating to the merger; the inability to realize expected cost savings and synergies from the merger of Vapor with Vaporin in the amounts or in the timeframe anticipated; Vapor’s operations and its ability to successfully execute its current business strategy changes in the estimate of non-recurring charges; costs or difficulties relating to integration matters might be greater than expected; changes in the stock price of Vapor or Vaporin prior to closing; material adverse changes in Vaporin’s or Vapor’s operations or earnings; the inability to retain Vapor’s customers and employees; or a decline in the economy, as well as the risk factors set forth in Vapor Form 10-K (and as supplemented by Item 1.A. in Vapor’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2014). These forward-looking statements are made as of the date of this press release, and Vapor assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements.

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger and upon the execution of a definitive merger agreement, Vapor intends to file a Registration Statement on Form S-4 that will include a joint proxy statement of Vapor and Vaporin and a prospectus of Vapor with the Securities and Exchange Commission (the “Commission”). Both Vapor and Vaporin may file other documents with the Commission regarding the proposed transaction. If a definitive merger agreement is executed by the parties, a definitive joint proxy statement will be mailed to the stockholders of Vapor and Vaporin. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE COMMISSION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the registration statement (when available), including the joint proxy statement/prospectus and other documents containing information about Vapor and Vaporin at the Commission’s website atwww.sec.gov. These documents may be accessed and downloaded for free at Vapor’s website atwww.vapor-corp.com or by directing a request to Harlan Press, Chief Financial Officer, Vapor Corp., at 3001 Griffin Road, Dania Beach, Florida 33312, telephone (888) 766-5351 or at www.vaporin.comor by directing a request to Jim Martin, Chief Financial Officer, Vaporin, Inc. at 4400 Biscayne Boulevard, Miami, Florida 33137, telephone (305) 576-9298.