Investment Bank

M&A, Private Equity & LP Equity for CRE

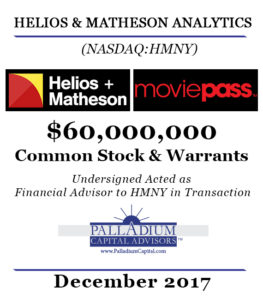

Palladium Capital Advisors, Financial Advisor on $60,000,000 Public Offering for Helios & Matheson Analytics (NASDAQ:HMNY)

NEW YORK– Palladium Capital Advisors, LLC acted as a financial advisor in connection with the following offering. Helios and Matheson Analytics Inc. (Nasdaq: HMNY) (“HMNY”), a provider of information technology services and solutions and a majority owner of MoviePass Inc. (“MoviePass”), the nation’s premier movie-theater subscription service, today announced the pricing of a best efforts underwritten public offering of an aggregate of 8,261,539 Series A units (the “Series A Units”), with each Series A Unit consisting of (i) one share of the Company’s common stock, par value $0.01 per share (the “Common Stock”), and (ii) one Series A Warrant to purchase one share of Common Stock (the “Series A Warrants”); and (B) 969,230 Series B units (the “Series B Units”, and together with the Series A Units, the “Units”), with each Series B Unit consisting of (i) one pre-funded Series B Warrant to purchase one share of Common Stock (the “Series B Warrants”, and together with the Series A Warrants, the “Warrants”) and (ii) one Series A Warrant, with anticipated gross proceeds of approximately $60 million, before deducting underwriting discounts and commissions and estimated offering expenses payable by HMNY. HMNY is offering the Units at a price of $6.50 per Unit. All of the Units are being offered by HMNY. The shares of Common Stock (the “Shares”) and the Warrants will be issued separately. The Series A Warrants will be initially exercisable on the first trading day following the one year anniversary of the date of issuance and will expire five years from the date such Series A Warrants are first exercisable at an exercise price of $7.25 per share. The Series B Warrant will be exercisable at any time on or after the issuance date until the five-year anniversary of the date of issuance. There is no established public trading market for the Warrants and HMNY does not expect a market to develop in the future. The offering is expected to close on or about December 15, 2017, subject to customary closing conditions. HMNY intends to use the net proceeds from this offering to increase the Company’s ownership stake in MoviePass or to support the MoviePass operations; to satisfy a portion or all of the amounts payable in connection with its outstanding convertible notes, to the extent that they remain outstanding; and for general corporate purposes.

NEW YORK– Palladium Capital Advisors, LLC acted as a financial advisor in connection with the following offering. Helios and Matheson Analytics Inc. (Nasdaq: HMNY) (“HMNY”), a provider of information technology services and solutions and a majority owner of MoviePass Inc. (“MoviePass”), the nation’s premier movie-theater subscription service, today announced the pricing of a best efforts underwritten public offering of an aggregate of 8,261,539 Series A units (the “Series A Units”), with each Series A Unit consisting of (i) one share of the Company’s common stock, par value $0.01 per share (the “Common Stock”), and (ii) one Series A Warrant to purchase one share of Common Stock (the “Series A Warrants”); and (B) 969,230 Series B units (the “Series B Units”, and together with the Series A Units, the “Units”), with each Series B Unit consisting of (i) one pre-funded Series B Warrant to purchase one share of Common Stock (the “Series B Warrants”, and together with the Series A Warrants, the “Warrants”) and (ii) one Series A Warrant, with anticipated gross proceeds of approximately $60 million, before deducting underwriting discounts and commissions and estimated offering expenses payable by HMNY. HMNY is offering the Units at a price of $6.50 per Unit. All of the Units are being offered by HMNY. The shares of Common Stock (the “Shares”) and the Warrants will be issued separately. The Series A Warrants will be initially exercisable on the first trading day following the one year anniversary of the date of issuance and will expire five years from the date such Series A Warrants are first exercisable at an exercise price of $7.25 per share. The Series B Warrant will be exercisable at any time on or after the issuance date until the five-year anniversary of the date of issuance. There is no established public trading market for the Warrants and HMNY does not expect a market to develop in the future. The offering is expected to close on or about December 15, 2017, subject to customary closing conditions. HMNY intends to use the net proceeds from this offering to increase the Company’s ownership stake in MoviePass or to support the MoviePass operations; to satisfy a portion or all of the amounts payable in connection with its outstanding convertible notes, to the extent that they remain outstanding; and for general corporate purposes.

Canaccord Genuity is acting as sole book-running manager and Maxim Group LLC is acting as co-manager for the offering. Palladium Capital Advisors, LLC acted as a financial advisor in connection with the offering.

The Units, the Shares, the Warrants and the shares of Common Stock underlying the Series B Warrants described above are being offered pursuant to a shelf registration statement previously filed with and declared effective by the Securities and Exchange Commission (“SEC”). A preliminary prospectus supplement and accompanying prospectus relating to the offering has been filed with the SEC and is available for free on the SEC’s website at www.sec.gov. Copies of the final prospectus supplement and accompanying prospectus relating to the offering will be filed with the SEC and will be available on the SEC’s web site at www.sec.gov. Copies of the final prospectus supplement and the accompanying prospectus relating to the offering may also be obtained, when available, from Canaccord Genuity Inc., Attention: Equity Syndicate Department, 99 High Street, 12th Floor, Boston, Massachusetts 02110, by telephone at (617) 371-3900, or by email at prospectus@canaccordgenuity.com.

This press release does not constitute an offer to sell or the solicitation of an offer to buy any of these securities, nor will there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale is not permitted.

About Helios and Matheson Analytics Inc.

Helios and Matheson Analytics Inc. (NASDAQ: HMNY) is a provider of information technology services and solutions, offering a range of technology platforms focusing on big data, artificial intelligence, business intelligence, social listening, and consumer-centric technology. HMNY owns a majority interest in MoviePass Inc., the nation’s premier movie-theater subscription service. HMNY’s holdings include RedZone Map™, a safety and navigation app for iOS and Android users, and a community-based ecosystem that features a socially empowered safety map app that enhances mobile GPS navigation using advanced proprietary technology. HMNY is headquartered in New York, NY and listed on the Nasdaq Capital Market under the symbol HMNY. For more information, visit us www.hmny.com.

About MoviePass

MoviePass Inc. (“MoviePass”) is a technology company dedicated to enhancing the exploration of cinema. As the nation’s premier movie-theater subscription service, MoviePass provides film enthusiasts with a variety of subscription options to enhance their movie-going experience. The service, now accepted at more than 91% of theaters across the United States, is the nation’s largest theater network. Visit: www.moviepass.com.

Safe Harbor Statement

This release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, including but not limited to statements regarding HMNY’s expectations on the completion, timing and size of the proposed public offering and the anticipated use of proceeds therefrom. These forward-looking statements are subject to a number of risks, including market conditions related to the proposed public offering and the risk factors set forth from time to time in HMNY’s SEC filings, including but not limited to the risks that are described in the “Risk Factors” section of HMNY’s Annual Report on Form 10-K for the year ended December 31, 2016 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2017, and in the preliminary prospectus supplement related to the proposed offering filed with the SEC, each available on the SEC’s web site at www.sec.gov. In addition to the risks described above and in HMNY’s other filings with the SEC, other unknown or unpredictable factors also could affect HMNY’s results. No forward-looking statements can be guaranteed, and actual results (including, without limitation, any anticipations about the benefits of HMNY’s acquisition of a majority interest in MoviePass, or about the business and future prospects of MoviePass itself) could differ significantly from those contemplated by the forward-looking statements. The information in this release is provided only as of the date of this release, and HMNY undertakes no obligation to update any forward-looking statements contained in this release on account of new information, future events, or otherwise, except as required by law.

Contacts

The Pollack PR Marketing Group

Investor Contact:

Stephanie Goldman/Mark Havenner, 310-556-4443

sgoldman@ppmgcorp.com / mhavenner@ppmgcorp.com