Investment Bank

M&A, Private Equity & LP Equity for CRE

What Are Hedge Funds?

There is no simple definition for hedge funds. Just like the terms “mutual fund” and “unit trust”, the designation “hedge fund” describes a type of investment structure without indicating anything about the investment strategy it employs. That is to say, just like a mutual fund might invest in highly speculative biotech stocks or ultra conservative short-term bonds, so too the term “hedge fund” can apply to a fund that employs almost any investment strategy and risk-profile.

The most fundamental distinctions between hedge funds and other pooled investment funds are that they are private structures-typically limited partnerships or private corporations-that pool capital from institutions and foundations as well as individuals and will almost always employ sophisticated investment strategies that do not depend on the general direction of bond or equity markets to earn their returns. Since hedge funds seek returns that are largely independent of general stock and bond market movements, they can be an important component of a diversified investment portfolio-reducing risk and increasing returns.

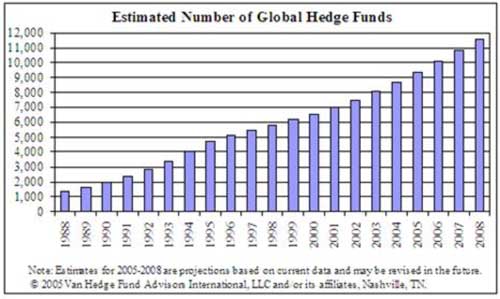

The first hedge fund began operation in 1949. It was managed by Alfred Winslow Jones, and during the 50’s and 60’s it substantially outperformed every mutual fund in the USA. In the past decade it is estimated that the number of hedge funds has been growing at an estimated rate of 20% each year, and that today there are around 9000 hedge funds, managing in excess of $1 trillion of sophisticated investor’s capital. The explosive growth of hedge funds has also brought about an expansion of the client base investing in these funds. While once considered the domain of the super-wealthy elite, a large portion of the new capital flowing into hedge funds comes from large institutional investors and sophisticated, modestly wealthy individual investors. Today, hedge funds are considered an essential asset class in most large institutional portfolios.